Business

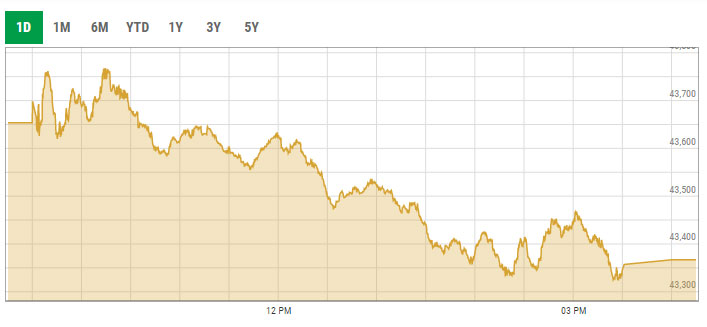

Trading volumes drop to 20-month low at PSX

-

Latest News3 days ago

Latest News3 days agoThe PTA discloses how many VPNs are registered in Pakistan.

-

Latest News3 days ago

Latest News3 days agoAaqib Javed designated as interim head coach for white-ball formats of Pakistan

-

Latest News2 days ago

Latest News2 days agoTwelve security personnel were killed in the attack on the Bannu checkpoint.

-

Business3 days ago

Business3 days agoIn terms of Pakistan’s Current Account: As information technology exports reached $330 million in October, Pakistan reports a CA surplus of $349 million.

-

Latest News1 day ago

Latest News1 day agoPakistan and Saudi Arabia have reached an agreement to implement a prisoner exchange arrangement.

-

Latest News1 day ago

Latest News1 day agoThe Supreme Court rejects SIC’s request to be recognized as a parliamentary party.

-

Latest News2 days ago

Latest News2 days agoPTI representatives conjecture in the media over Imran’s approval of bail: FIA investigator

-

Entertainment2 days ago

Entertainment2 days agoAryan Khan’s Netflix debut web series is announced by Shah Rukh Khan.