Business

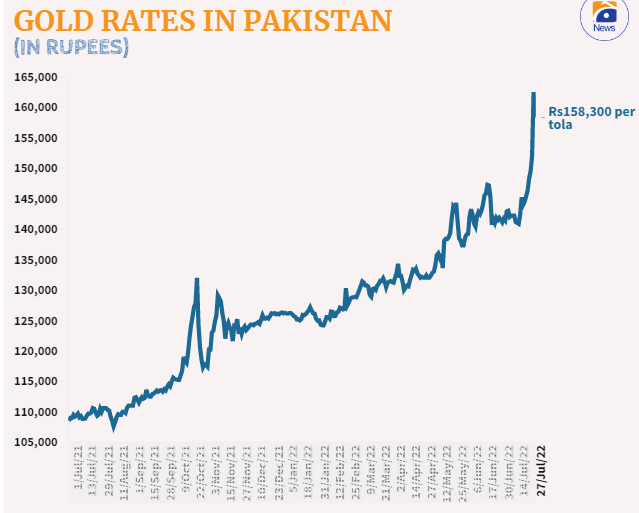

Gold loses shine, price plunges by Rs4,200 per tola

Business

SIFC Promotes International Honey Trade: Malaysia Becomes an Export Destination for KP 60,000 Honey Farms

Business

The KSE-100 is getting closer to the 100,000 level thanks to bullish momentum.

Business

Irfan Siddiqui meets with the PM and informs him about the Senate performance of the parliamentary party.

-

Latest News3 days ago

Latest News3 days agoPakistan Establishes 20 New Trade Posts in China to Increase Investment and Exports

-

Latest News3 days ago

Latest News3 days agoIranian President Offers Condolences for Kurram Terrorist Attack

-

Latest News3 days ago

Latest News3 days agoPresident and PM Applaud Security Forces for Bannu, Balochistan IBOs in the War Against Terror

-

Latest News3 days ago

Latest News3 days agoThe Punjab government will fulfill the common man’s dream of a home: Maryam Nawaz

-

Latest News3 days ago

Latest News3 days agoExamining Drug Mafia: Balochistani Smuggling Operation Started

-

Latest News3 days ago

Latest News3 days agoIt’s unfortunate that political points were scored. Claims Against Saudi Arabia Show a Desperate Attitude: Dar

-

Latest News3 days ago

Latest News3 days agoAccording to Defense Minister Khawaja Muhammad Asif, accusations made against Pakistan by Bushra Bibi, the spouse of the PTI founder, are vile and disgusting because Pakistan has historical relations to the Kingdom of Saudi Arabia.

-

Latest News3 days ago

Latest News3 days agoBannu IBO: Security Guards Take Weapons and Explosives, Kill Three Khwarij