Business

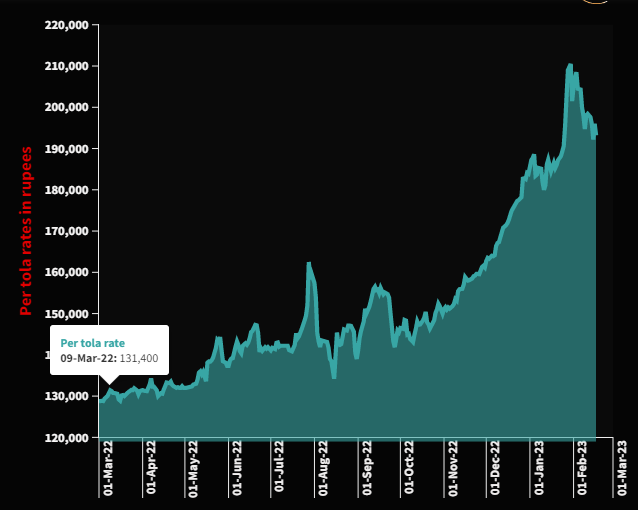

Gold rate declines in Pakistan as rupee gains ground

-

Latest News1 day ago

Latest News1 day agoThe BCCI has confirmed that Pakistan’s name will be on India’s jersey during the Champions Trophy.

-

Latest News2 days ago

Latest News2 days agoWhatsApp launches bulk channel management functionality

-

Entertainment2 days ago

Entertainment2 days agoKubra Khan has officially announced her wedding date – Here are all the facts!

-

Latest News2 days ago

Latest News2 days agoProviding the best travel facilities as a top priority is a key priority for the provision of safety measures on highways.

-

Latest News1 day ago

Latest News1 day agoChinese New Year Festivities: CPEC-2 Will Create Vast Possibilities: Ahsan

-

Business2 days ago

Business2 days agoAccording to projections made by the World Bank, Pakistan’s gross domestic product will expand by 2.8% during the fiscal year 2024-25.

-

Entertainment1 day ago

Entertainment1 day agoAhad Raza Mir and Dananeer Mobeen’s tight relationship has sparked rumours!

-

Business2 days ago

Business2 days agoSIFC and UNICEF Collaborate on Youth Training: $1.5 Million Girls’ Education Agreement