- “Govt has fulfilled all requirements of IMF,” the interior minister says.

- He adds after agreement relief could be passed on to the public.

- Pakistan and IMF are engaged in tough talks since late January.

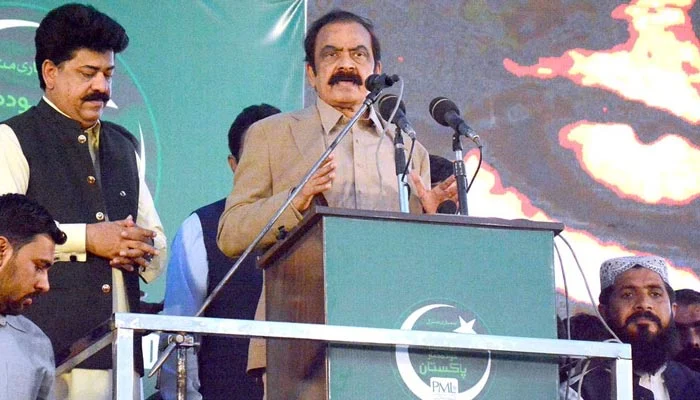

ISLAMABAD: With all eyes on the International Monetary Fund (IMF) for their final nod, Interior Minister Rana Sanaullah has said the agreement with the lender would be inked formally during next week, Radio Pakistan reported on Tuesday.

The two sides are engaged in tough talks to reach a consensus on multiple conditions since late January before signing the deal which also includes external financing from friendly countries.

Sanaullah, addressing a public gathering in Faisalabad, said that the government has fulfilled its all requirements and after the agreement relief could be passed on to the public.

A day earlier, Finance Minister Ishaq Dar told Geo News that Pakistan has “fulfilled all the conditions” of the IMF and hoped that the Fund will soon sign the staff-level agreement, paving the way for the release of the $1.1 billion tranche.

Dar said both Saudi Arabia and the United Arab Emirates (UAE) have informed the IMF about their commitments to provide $3 billion to Pakistan.

Riyadh will provide $2 billion while Abu Dhabi has promised $1 billion to Pakistan, Dar said, adding that the Washington-based lender has also been informed in this regard.

The finance minister said all the conditions for the staff-level agreement between Pakistan and IMF have been fulfilled.

“Pakistan is hopeful that IMF will soon sign the SLA and get it approved by its Executive Board,” Dar added.

The country’s foreign exchange reserves have fallen to cover barely a month of imports after the IMF funding stalled in November, hit by snags over fiscal policy adjustments after officials of the lender visited Islamabad in February for talks.

They formed part of a ninth review exercise on a bailout package of $6.5 billion agreed upon in 2019 whose resumption is critical for Pakistan to avoid risking default on external payment obligations.

Pakistan had to complete actions demanded by the IMF, such as reversing subsidies in its power, export and farming sectors, hikes in the prices of energy and fuel, and a permanent power surcharge, among other measures.

These steps included jacking up its key policy rate to an all-time high of 21%, a market-based exchange rate, arranging for external financing, and raising more than Rs170 billion ($613 million) in new taxes.

The fiscal adjustments have already fuelled Pakistan’s highest inflation ever, which climbed in March to more than 35% on the year.

The IMF programme will disburse another tranche of $1.4 billion to Pakistan before it concludes in June.

Funds from the lender will also unlock other bilateral and multilateral financings for the cash-strapped country.

Neighbouring China has rolled over $2 billion and refinanced another $1.3 billion in recent weeks.

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago

Latest News12 hours ago