Business

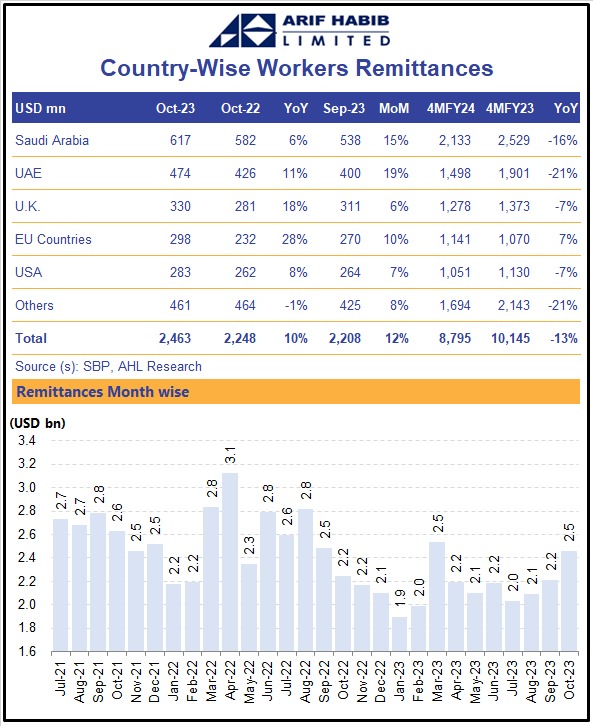

Workers’ remittances increase by 11.5% in October

-

Latest News4 hours ago

Latest News4 hours agoIn Sharaqpur, two children drown while taking a bath in a canal.

-

Latest News4 hours ago

Latest News4 hours agoPresident Zardari will speak to a joint session of parliament today as we begin a new parliamentary year.

-

Latest News4 hours ago

Latest News4 hours agoBeyond Political Affiliation, PML-N Will Serve the Masses

-

Latest News4 hours ago

Latest News4 hours agoDPM Restates Abundant Support for the Palestinian Cause

-

Latest News5 hours ago

Latest News5 hours agoGovernment team and IMF start discussing agricultural income tax

-

Latest News4 hours ago

Latest News4 hours agoPTI Encouraged Chaos and Sabotage: Rana Tanveer

-

Latest News4 hours ago

Latest News4 hours agoDY PM Talks With World Leaders About Bilateral Partnerships

-

Latest News4 hours ago

Latest News4 hours agoNA, Senate Sessions: Tomorrow’s Meeting of Both Houses of Parliament