Business

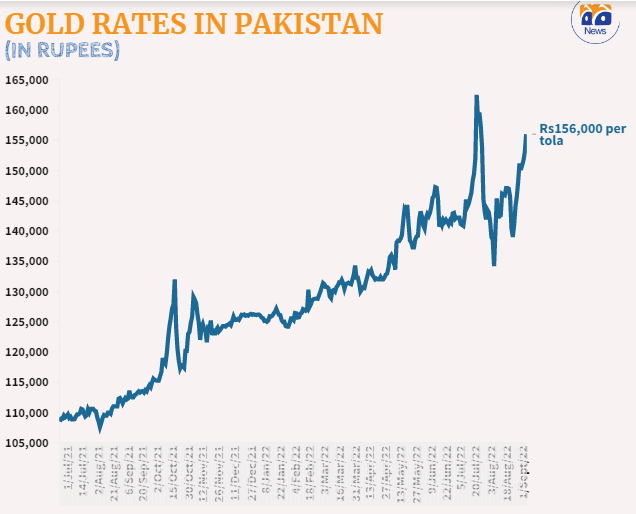

Gold continues to shine, heads for major weekly rise

Business

SIFC Promotes International Honey Trade: Malaysia Becomes an Export Destination for KP 60,000 Honey Farms

Business

The KSE-100 is getting closer to the 100,000 level thanks to bullish momentum.

Business

Irfan Siddiqui meets with the PM and informs him about the Senate performance of the parliamentary party.

-

Latest News10 hours ago

Latest News10 hours agoPTI’s protest accuses the president of Belarus of conspiring against the country. The president is due in ICT today. Dar

-

Latest News9 hours ago

Latest News9 hours agoThe public rejects repeated calls for protests and sit-ins because PTI wants to disrupt daily life. Ahsan

-

Latest News9 hours ago

Latest News9 hours ago23 police officers were hurt in an altercation with PTI employees on Attock’s Ghazi Barotha Bridge.

-

Latest News10 hours ago

Latest News10 hours agoMaintaining Law and Order: Naqvi Visits D-Chowk To Raise Police, FC, and Rangers’ Morale

-

Latest News10 hours ago

Latest News10 hours agoAnti-Power Theft Campaign: Government Crackdown on Power Theft Recovers 133 Billion Rupees

-

Latest News9 hours ago

Latest News9 hours agoStrengthening Bilateral Relations: A Delegation of 68 Belarusians Arrives in Islamabad

-

Latest News10 hours ago

Latest News10 hours agoBushra Bibi and Imran Khan are accused of inciting the PTI’s protest confrontations on November 24.

-

Latest News9 hours ago

Latest News9 hours agoAttaullah Tarar, the minister of information, travels to different parts of Islamabad; the majority of the city’s roads are open.