Business

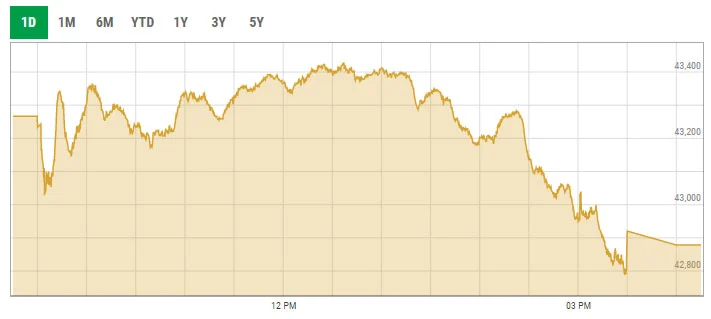

Bears hold sway at PSX as political tensions weigh

-

Latest News3 days ago

Latest News3 days agoPakistan Achieves Macroeconomic Stability: Finance Minister Aurangzeb Highlights Government Success

-

Latest News3 days ago

Latest News3 days agoFour Pakistanis were saved from people smugglers by the Pakistan Embassy in Iran.

-

Latest News3 days ago

Latest News3 days agoAddressing a seminar, the finance minister said that Pakistan is making progress.

-

Latest News3 days ago

Latest News3 days agoFederal Tax Ombudsman’s Seminar in Quetta: Jafar Khan Must Respect Taxpayers and Address Their Complaints

-

Latest News3 days ago

Latest News3 days agoPM Meets Chief Justice: Talks About Missing Persons, Pending Tax Disputes, and Judicial Reforms

-

Latest News3 days ago

Latest News3 days agoURAAN Pakistan Promotes Equality to Encourage Inclusion ETHICS: PM

-

Latest News3 days ago

Latest News3 days agoAt the ceremony, the minister speaks on URAAN Pakistan’s commitment to sustainable national development. Ahsan

-

Latest News3 days ago

Latest News3 days agoPunjab chooses to implement development initiatives in important cities.