Business

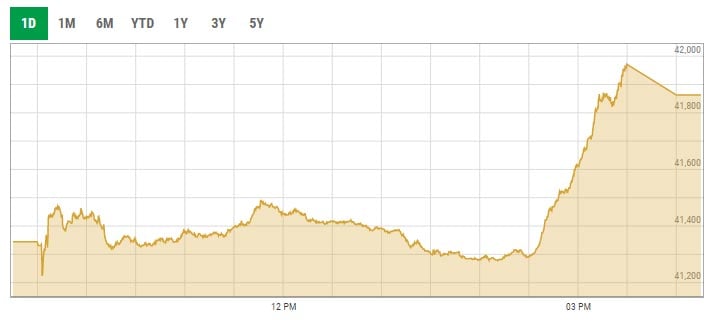

KSE-100 gains over 500 points on hopes of IMF programme revival

-

Latest News3 days ago

Latest News3 days agoUnder the auspices of Ombudsman Punjab, an awareness seminar was held at the Government Mc High School in Nakana Sahib.

-

Latest News3 days ago

Latest News3 days agoRoad Extension Project: Bugti Launches Quetta Road Extension Project

-

Latest News3 days ago

Latest News3 days agoMandi Bahauddin District Jail: MNA Launches Improvement Initiatives at Jail

-

Latest News3 days ago

Latest News3 days agoPRBC Delegation Calls PM Shehbaz: PM Directs Committee Formation to Address Retailers’ Concerns

-

Latest News3 days ago

Latest News3 days agoEnhancing Pakistan-Bahrain Collaboration: Tarar Highlights Fortifying Media Connections Between Pakistan and Bahrain

-

Latest News3 days ago

Latest News3 days agoBarrister Saif: Imran will never be involved in any deal like Nawaz

-

Latest News3 days ago

Latest News3 days agoSindh Canal System: $120 million project launched by the provincial government with WB support

-

Latest News3 days ago

Latest News3 days agoSenate Session: Rana Tanveer: Government Is Not Closing Utility Stores