Business

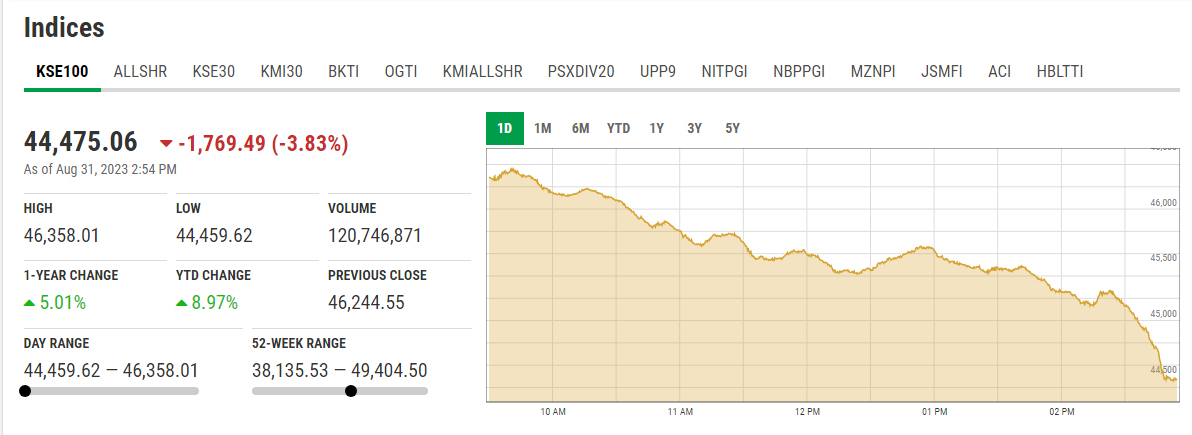

KSE-100 nosedives over 1,700 points as economic turmoil dents investors’ confidence

-

Latest News3 days ago

Latest News3 days agoUNSC Briefing on Yemen: Pakistan Demands Urgent Humanitarian Assistance and Discussion

-

Latest News3 days ago

Latest News3 days agoThe arrest of Shareefullah demonstrates the vitality of Pakistan-US cooperation in the fight against terrorism.

-

Latest News3 days ago

Latest News3 days agoReduced Electricity Prices: Under the January FCA, NEPRA Reduces Tariff by Rs 2.12 Per Unit

-

Latest News3 days ago

Latest News3 days agoDevelopment Project in Lahore: CM Punjab Directs Canal Desalination

-

Latest News3 days ago

Latest News3 days agoThe SC requests a daily update on the Arshad Sharif murder case.

-

Latest News3 days ago

Latest News3 days agoParliamentary Meeting: On Monday, the President Calls a Joint Session of Parliament

-

Latest News3 days ago

Latest News3 days agoChinese Leaders Are Congratulated by the PM for Successful CPPCC Sessions

-

Latest News3 days ago

Latest News3 days agoCOAS Visits Bannu and Promises Terrorism Justice